Goodwill Explained

Goodwill is an intangible asset that gets created when a company acquires another company. Most finance professionals are pretty comfortable with this idea. It’s also fair to say that Goodwill often carries negative connotations. Since Goodwill is (at a high level) the premium paid over the value of the net assets (also referred to as the book value of equity) of the target firm, people sometimes equate it with “overpaying”. In addition, since Goodwill needs to be tested annually for impairment, it could cause a nasty one-time charge down the road. To some, Goodwill is viewed as “bad” – so should we call it “Badwill”? Deep thoughts.

Let’s dive a little deeper to make sure we understand (a) how Goodwill is really calculated and (b) what it really represents.

Calculating Goodwill

The first thing to know is that Goodwill only gets created on the buyer’s balance sheet when it will “consolidate” the target company. This typically happens when the buyer will own over 50% of the target (although the true accounting test is based on control over the target’s business as opposed to the percentage of shares owned). When the target is being consolidated, the buyer includes 100% of the assets and liabilities of the target on its balance sheet.

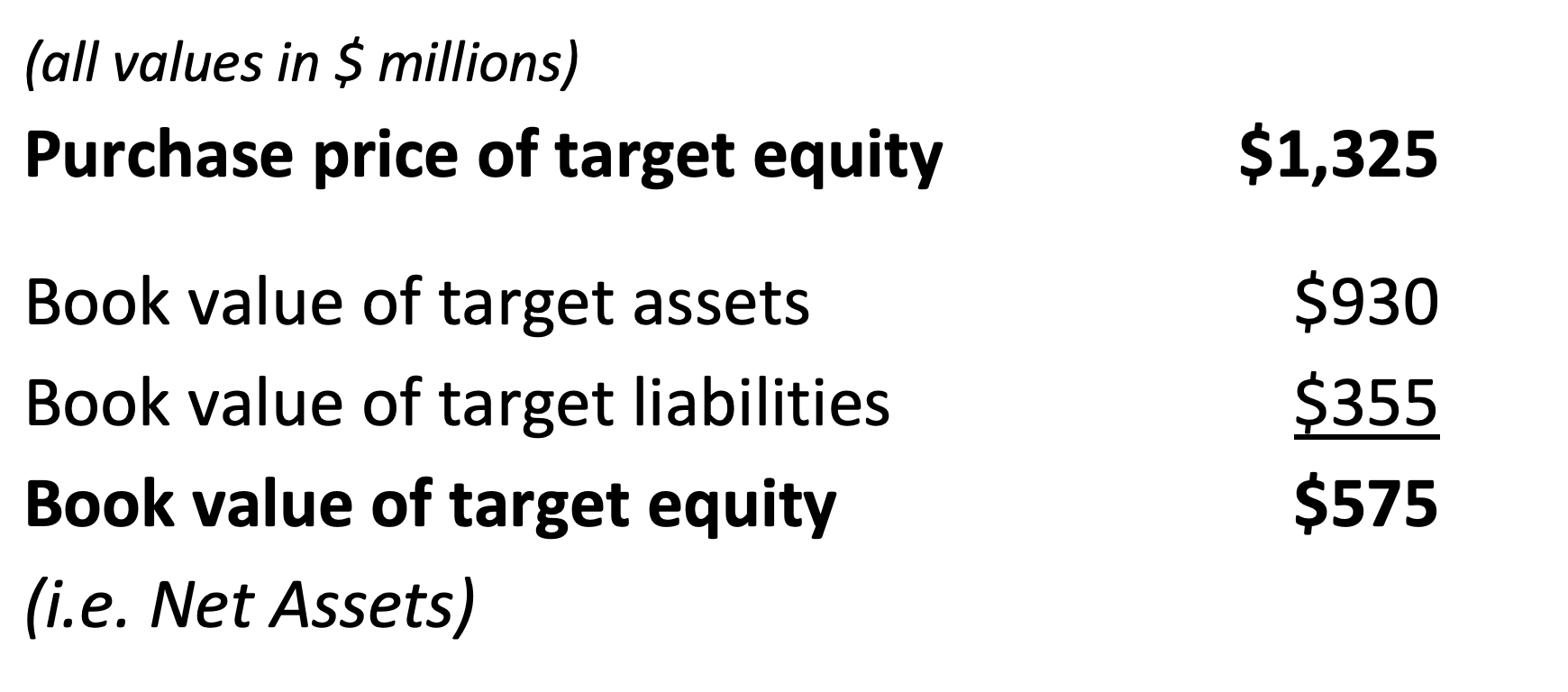

Many people think of the Goodwill from an acquisition as the premium the buyer is paying over the “book” value (or accounting carrying value) of the target’s equity (remember that equity is just total assets less total liabilities). Consider the following set of facts for a hypothetical acquisition:

The difference between the equity purchase price and the book value of the target equity is $750 mm ($1,325 mm – $575 mm), but this is NOT the number we call Goodwill… at least not yet. Think of the $750 mm as exactly what it is…the premium the buyer is paying over the book value of the target’s equity. This “excess purchase price” needs to go through the Purchase Price Allocation (“PPA”) process first before we can determine the amount of Goodwill.

Purchase Price Allocation in a Nutshell

Purchase price allocation is an accounting process which occurs when a target is purchased and will be consolidated into the acquirer. Through PPA, the acquirer allocates the purchase price of the target’s equity among:

- The fair market value (“FMV”) of the identifiable net assets of the target (excluding pre-existing any target Goodwill); and

- Goodwill.

PPA assigns the purchase price of a company to the acquired company’s assets valued at FMV (less, or “net” of, liabilities at fair value), and recognizes any unassigned portion of the purchase price as Goodwill. Goodwill is therefore the “unexplained” portion of the purchase price in that it can’t be attributed to other net assets.

Thus, before we can determine the Goodwill caused by the acquisition, we need to value all the assets and liabilities of the target at FMV. Some of the assets that need to be revalued may already be on the target’s balance sheet. For example, perhaps the target owns some land that was purchased a long time ago and is being carried at cost on the target’s balance sheet. At FMV, this land would be worth more so it would be written up for accounting purposes as part of the PPA process. This will account for some of excess purchase price.

However, other assets that are written up to FMV may not have previously been on the balance sheet. Intangible assets, such as brands or client lists, won’t have appeared on the balance sheet if they were created by the target company. But through PPA, the accountant tries to ascribe value to these assets to explain some of the premium. This happens only because of the acquisition.

Any “unexplained” purchase price is therefore called Goodwill

Important note: when going through the PPA process, any pre-existing Goodwill that was already on the target’s balance sheet (from acquisitions the target made) would be excluded from the calculation of FMV of the net assets (it is ignored). As a result, the Goodwill for the transaction will essentially include any pre-existing target Goodwill.

A PPA Example

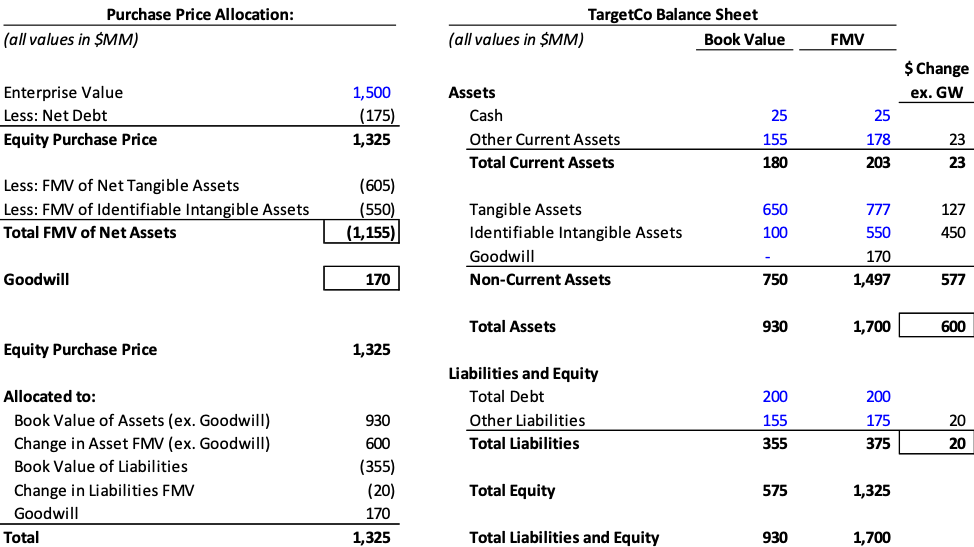

The table below illustrates an example transaction where AcquireCo is acquiring 100% of TargetCo for an enterprise value of $1.5 billion. As a result, the PPA process requires that we:

- Determine the equity purchase price EPP of $1,325 mm (total enterprise value less net debt of target)

- Write-up (or down) the target’s assets and liabilities to their FMV, as represented by the “FMV” column of TargetCo’s Balance Sheet

- In the example, assets (ex. Goodwill) are being written up by $600 mm (to $1,530 mm) and liabilities by $20 million (to $375 mm), so the increase in net assets is $580 million, from $575 mm to $1,155 mm

- Note that the value intangibles are being increased from $100 mm to $550 mm – this would likely include previously unrecognized intangibles

- Any excess purchase price over the FMV of the target’s net assets is allocated to Goodwill which will be shown on AcquireCo’s Balance Sheet

- In this case goodwill is $170 mm, or $1,375 mm less $1,155 mm

Example of Purchase Price Allocation

The end result of PPA is that Goodwill will make the acquirer’s balance sheet balance. Remember that the buyer is financing the purchase of the FMV of the target’s net assets with new capital (debt or equity) or by using cash on hand. Every dollar of that funding hits the acquirer’s balance sheet, so for it to balance a net asset must change by the same amount. If the FMV of the net assets doesn’t get us all the way there, the buyer must be buying another asset that the accountants can’t put their finger on… so it’s called Goodwill.

What Does Goodwill Really Represent?

If the accountants are valuing the net assets of the target at “FMV”, why would the buyer pay more? There could be two explanations for this:

- The buyer thinks the target’s net assets are worth more that the accountant’s FMV estimates; and/or

- There are synergies the buyer can achieve through the acquisition. The extent to which the buyer is willing to share, or pay for, some of the value of those synergies is included in the equity purchase price.

A simple way to think about Goodwill is therefore:

Goodwill =

The difference between (i) what the buyer thinks the target’s stand-alone net assets are really worth and (ii) the accounting FMV value of those net assets

+

The dollar amount of anticipated present value of synergies being paid to the selling shareholders

Is this by definition a bad thing? Only time will tell. If the buyer overestimated the value of the target, it won’t be able to justify the equity purchase price in the future and will have to “impair” and write-down the Goodwill. But if the synergies are better than expected and the target performs well, the buyer may prove to have acquired the assets of the target company for a good price.