Dealing with Synergies in Precedent Transaction Analysis

When an acquirer buys a target company, what are they really getting? They are acquiring assets that generate cash flows, but they are also buying something else, and this often gets captured incorrectly in transaction valuation multiples.

In this article, we will examine EV/EBITDA, a common transaction valuation multiple and demonstrate how it can be significantly miscalculated in the context of an acquisition.

In practice, we often use comparable transaction multiples (also referred to as precedent transaction multiples), such as EV/EBITDA, as a benchmark for valuation. In other words, we look at the multiples paid for similar targets to get a sense for how much a dollar of EBITDA might be worth in an M&A context.

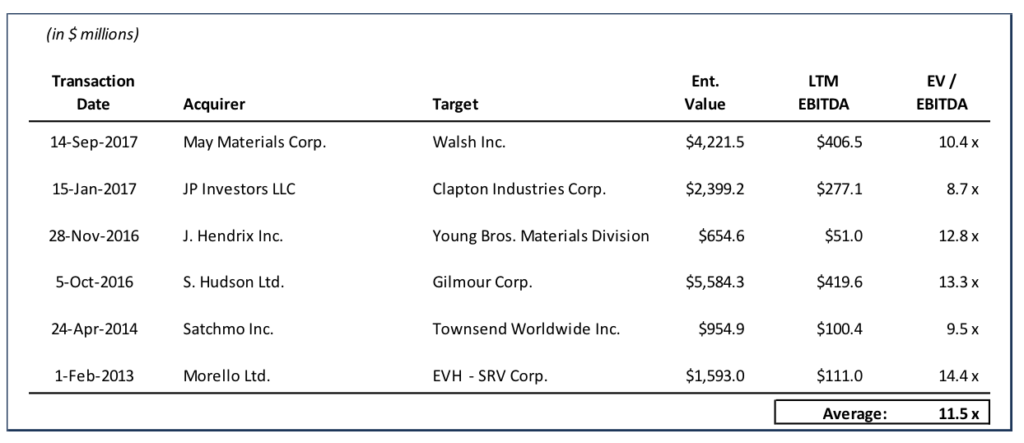

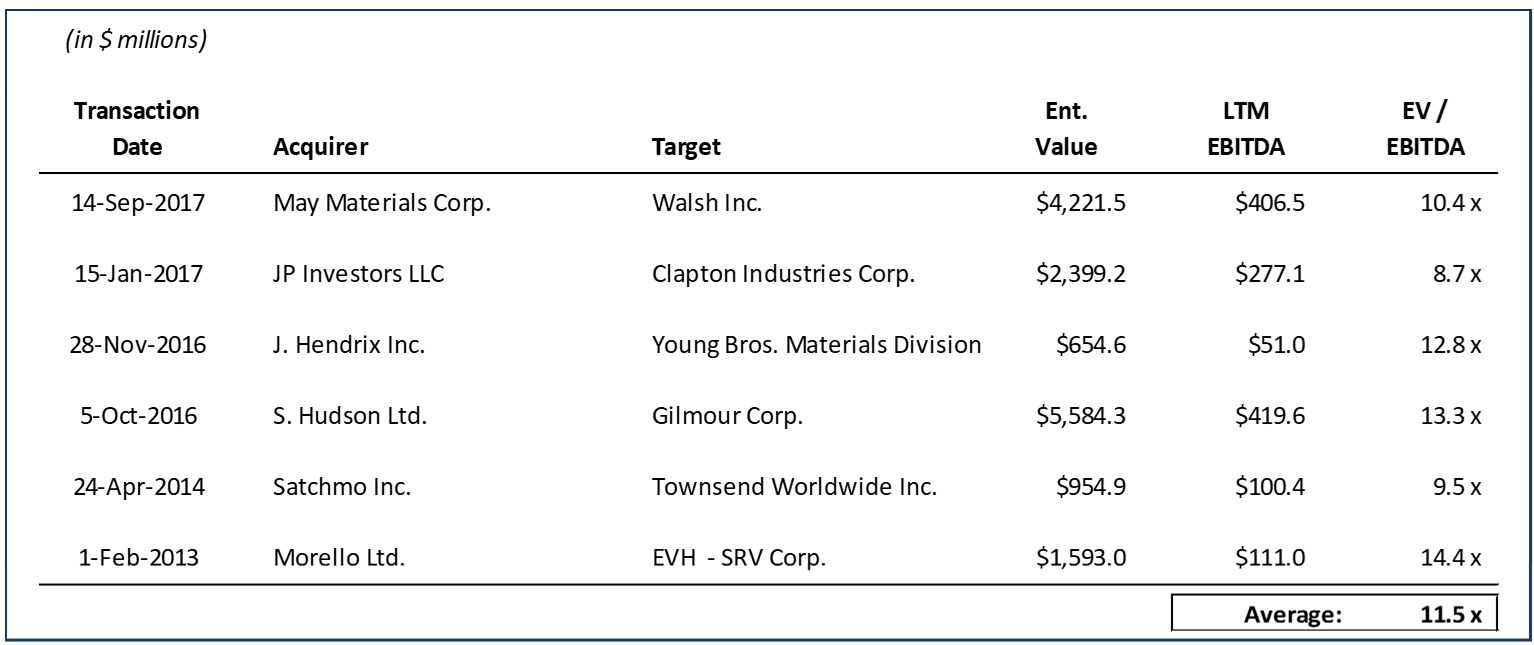

Let’s say for a given industry, the set of relevant precedents looks like this (see if you can spot the common theme in the company names by the way):

How do we use these multiples – do we just use the average EV/EBITDA from these deals and apply it to the target’s LTM EBITDA? Probably not, as we want the ones that are the most “comparable”. So to do this, we need to try to explain the variation in the multiples – the low multiple is 8.7x and the high is 14.4x. That’s a wide range. What are the possible reasons for this?

- Timing: We need to consider the underlying public valuation levels at the time of each of these deals compared to today.

- EBITDA Growth: The multiples only look at LTM EBITDA – some of these targets may have had better EBITDA growth prospects than others, which would of course influence the multiple paid.

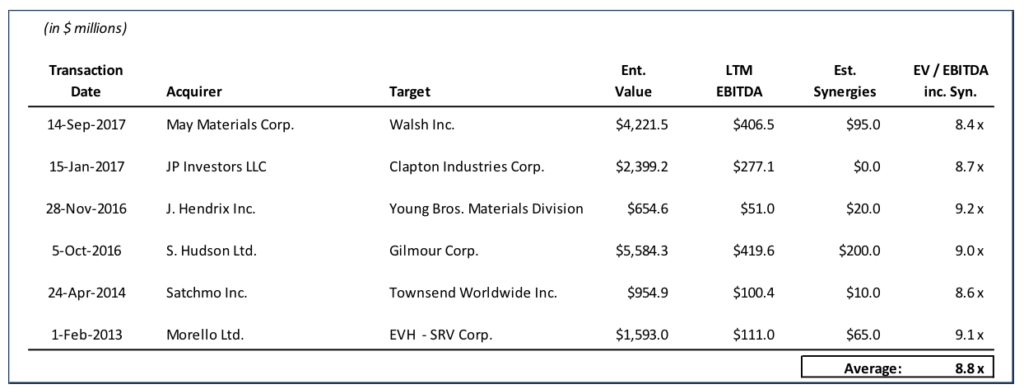

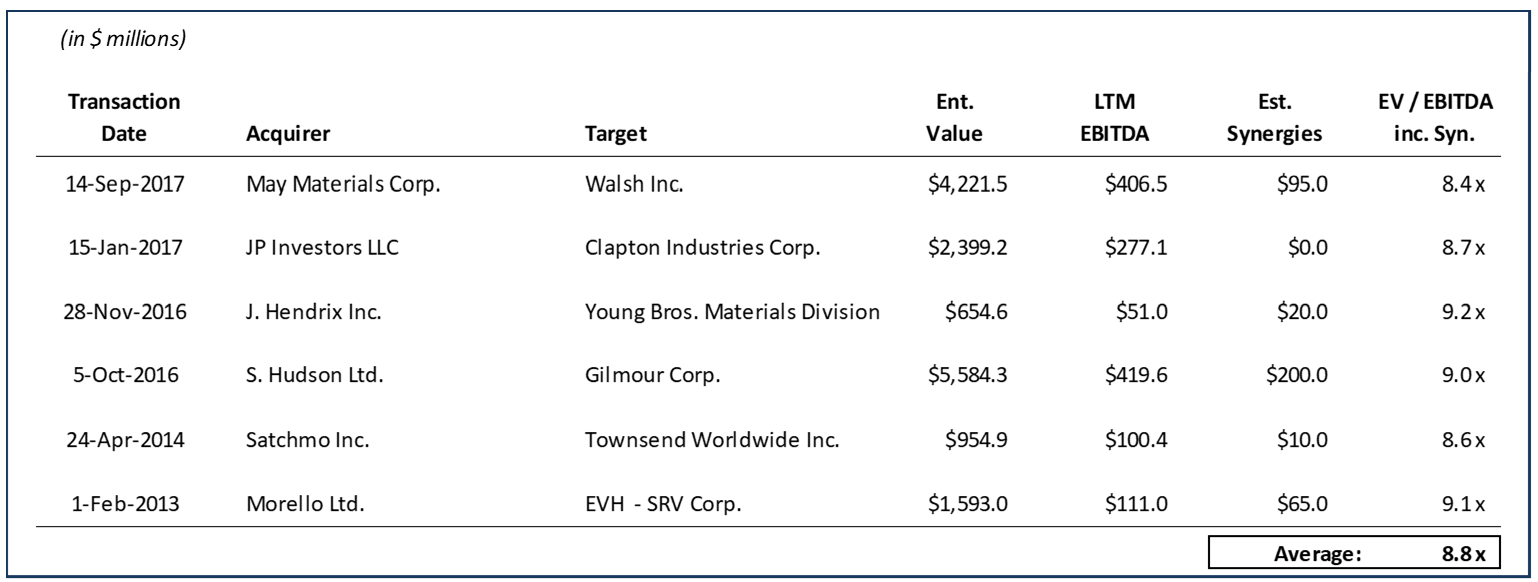

But more than anything, what’s not explained by the above points is something that people often forget to look at when putting together transaction multiples. What target EBITDA should we look at? It should be whatever EBITDA the buyer is getting, or rather think they are getting. This, of course, would include…..synergies. If the buyer anticipates a high level of synergies, all else being equal, they should be prepared to pay a higher multiple.

It follows then that it doesn’t make sense to analyze transaction multiples without including the estimated synergies in the EBITDA. In fact, we should include a full year’s worth of “run rate” synergies to understand the “true” multiple. Doing this typically makes the observed multiples converge and provides a more instructive analysis in doing valuation work.

Here’s the same info now including estimated synergies:

Finding an estimate for synergies number is not always easy. In many cases, you need to look at press releases, investor presentations, research reports or even conference call transcripts. But given the importance of synergies in valuation decisions, it makes good sense to try to find an estimate to make our output more meaningful.